Following years of lobbying from Washington, Japan and the Netherlands agreed on Friday to tighten restrictions on the export of chip manufacturing know-how to Chinese language corporations. Information of the settlement was reported by Bloomberg, the Monetary Instances, and The New York Instances.

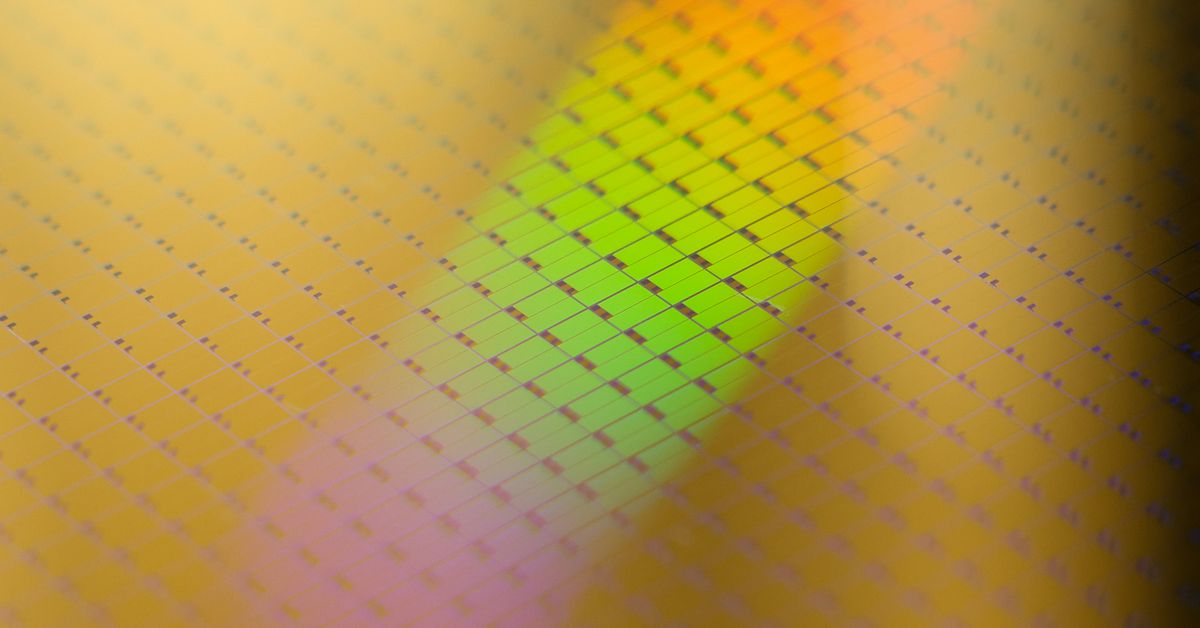

The controls are designed to restrict China’s capacity to ramp up its personal home chip manufacturing and are available after the Biden administration introduced comparable restrictions in October 2022. The worry is that simpler entry to superior semiconductors will permit China to shore up its army and synthetic intelligence capabilities.

There aren’t any plans for a public announcement concerning the settlement, and it might take “months” for Japan and the Netherlands to “finalize authorized preparations,” in accordance with Bloomberg.

“That is such a delicate subject that the Dutch authorities chooses to speak diligently, and that implies that we solely talk in a really restricted manner,” Netherlands Prime Minister Mark Rutte stated throughout a press convention on Friday when requested concerning the deal.

ASML is probably the most important firm affected by the Netherlands’ restrictions. It’s the one firm on this planet that produces so-called ultraviolet lithography machines, that are important to the manufacturing of superior semiconductors. CNBC beforehand reported that the corporate was already unable to ship its superior excessive ultraviolet lithography (EUV) machine to China however that it may nonetheless ship older deep ultraviolet lithography (DUV) machines.

“If they can’t get these machines, they are going to develop them themselves”

The brand new restrictions are anticipated to stop the sale of “a minimum of some” of those DUV machines, Bloomberg beforehand famous, which can additional restrict the flexibility of Chinese language corporations to provide superior chips and arrange manufacturing strains. ASML CEO Peter Wennink beforehand advised CNBC that China accounted for round 15 p.c of the corporate’s gross sales in 2022.

Wennink has stated that any restrictions are unlikely to stop China from constructing its personal variations of the machines finally. “If they can’t get these machines, they are going to develop them themselves,” Wennink advised Bloomberg. “That may take time, however finally they are going to get there.”

On the Japanese aspect, the restrictions are anticipated to influence corporations similar to Nikon and Tokyo Electron.

In addition to reducing off exports to China, the White Home has used its affect to stimulate home chip manufacturing. President Joe Biden signed the $280 billion CHIPS and Science Act final August, which incorporates $52 billion in subsidies for semiconductor manufacturing. Intel, TSMC, and Samsung have all both introduced or are actively constructing new semiconductor manufacturing services within the US.