Following a report final week that Apple retail workers at the moment are actively testing Apple Pay Later within the U.S., it seems the corporate is now gearing up for a public launch of the service, and with that, we’re getting some extra perception into precisely how Apple will resolve who qualifies for these pay later loans.

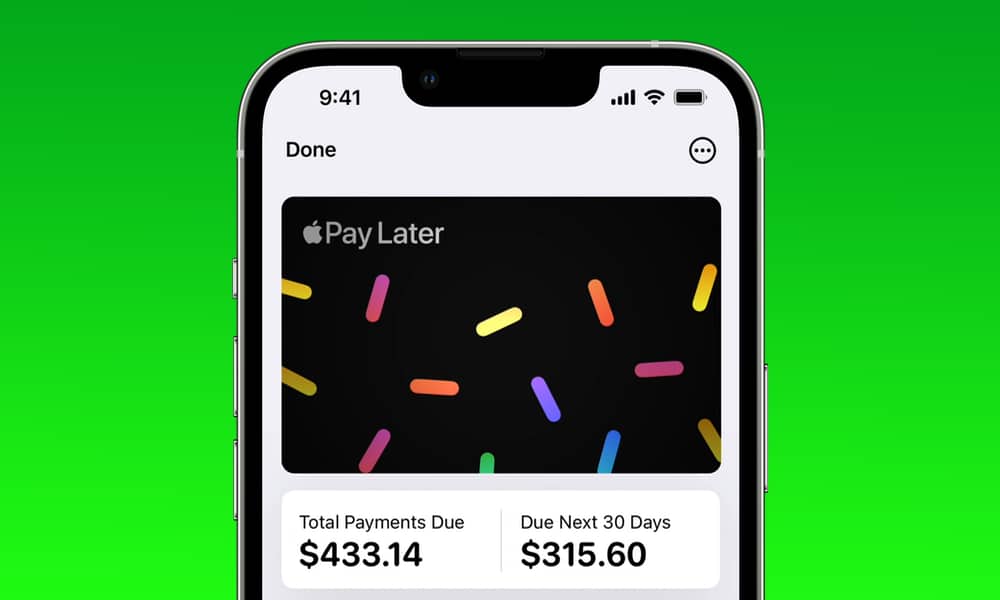

Apple Pay Later was first introduced as a part of the iOS 16 unveiling finally 12 months’s Worldwide Builders Convention (WWDC) as a strategy to enable Apple Pay customers to divvy up giant purchases into 4 equal funds over six weeks.

In that sense, it’s not a lot completely different from a few of the packages already loved by Apple Card holders. The important thing distinction with Apple Pay Later is that it’s going to work with practically any fee card that’s suitable with Apple Pay. We additionally already know that it ought to work with any service provider that accepts Mastercard funds, and it’s dealt with fully in Apple’s Pockets app in your iPhone, so the shop you’re visiting isn’t concerned in any respect; the service provider receives the total fee instantly from Apple by a digital Mastercard, after which Apple collects the installment funds out of your most popular fee methodology.

How A lot Will I Be In a position to Spend with Apple Pay Later?

Whereas Apple defined a lot of the technical particulars of Apple Pay Later final 12 months, it was a lot vaguer about precisely how the credit score checks and mortgage approvals for the service would work. Presumably, Apple isn’t going to advance funds to simply anyone, so it’s cheap to imagine that there might be a credit score test to make sure that you’ll have the ability to make the mandatory funds.

Due to the widespread trials ongoing amongst Apple retail workers, we’ve a barely higher thought of what that may seem like. Based on Bloomberg’s Mark Gurman, one of many key elements might be your buyer historical past with Apple itself.

This can embody your spending historical past with Apple — from retail shops to the App Retailer — and even which of the corporate’s units you personal. It should additionally contemplate whether or not you’ve utilized for an Apple Card, what number of different playing cards you’ve arrange for Apple Pay, and your historical past of person-to-person funds with Apple Money.

Whereas which will appear a bit too particular, it’s not an unreasonable strategy. It’s preferable to Apple operating a extra complete credit score test each time a buyer needs to go for Apple Pay Later, and it’s significantly much less invasive since Apple is wanting on the knowledge it already has on its clients reasonably than pulling in private knowledge from different sources.

Since Apple can be the lender on this case — it’s arrange its personal subsidiary financing firm to deal with this — it has plenty of flexibility in evaluating clients to resolve who it’s keen to mortgage cash to — and the way giant of an quantity it’s going to approve.

Whereas the main points of that course of are nonetheless considerably opaque, Gurman notes that lots of the workers testing the service are seeing mortgage approvals for $1,000 and underneath. That’s consistent with what many rival pay-later companies provide, and Apple possible needs to encourage clients in search of bigger quantities to use for an Apple Card as a substitute.

Based on Gurman, the Apple Pay Later mortgage presents are legitimate for as much as 30 days, however they might not be as instantaneous as we’d hoped. In some circumstances, clients might be required to offer a replica of a authorities identification card and their full social safety quantity. The Apple account additionally must have two-factor authentication enabled for safety causes.

Happily, it seems that mortgage standing with Apple Pay Later — whether or not you’re authorised, declined, or carrying a stability — received’t have an effect on entry to different Apple companies. Buyer data, comparable to transaction histories, might be saved solely with Apple Financing LLC, an arms-length subsidiary of Apple, together with Goldman Sachs and Mastercard. For privateness causes, Apple itself received’t have entry to this data.

Though Apple has not confirmed a launch date for Apple Pay Later, Gurman suggests it’s going to arrive “within the coming weeks,” at the least within the U.S. There’s no phrase in any respect when — or if — it’s going to ever develop internationally, but when Apple Money and the Apple Card are any indications, we’re not holding our breath for that.