Ever since Robinhood hit the scene in 2015, now we have seen an enormous inflow of each retail buyers and retail investing purposes. Regardless that Robinhood has had its points, they did show that the typical particular person likes the thought of having the ability to make investments when they need, how they need, and at little to no price. This new mannequin despatched shockwaves via the normal investing world.

Now, eight years later, it looks as if everybody from legacy banks to fintech startups have their very own investing apps, and it’s troublesome to resolve the place to place your hard-earned cash. I wished to speak about three investing apps which are nice for anybody trying to both get began or proceed their investing journey. Listed below are my favourite investing apps for iOS!

Earlier than we begin

This isn’t investing recommendation; I’m not a monetary advisor. Please do your individual analysis earlier than investing within the inventory market. The entire apps talked about may also have a crypto investing function, however I’m going to be avoiding that and principally talking about conventional inventory investing (which is way safer). I’m additionally primarily these apps from an iOS lens. A few of these apps have a desktop view, however I like to make use of my iPhone for investing, so that’s the place I’m judging my person expertise! Let’s get began!

1. Public Investing

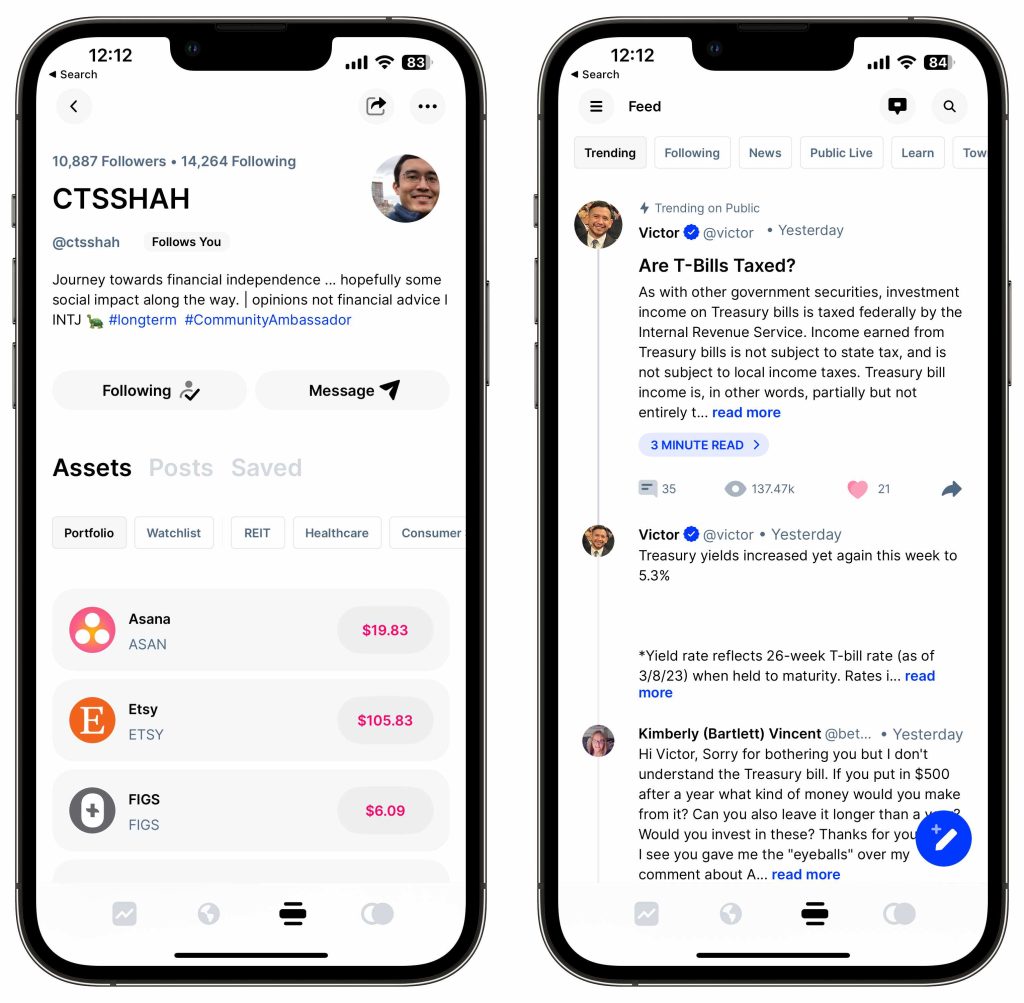

Public is a free investing app that goals to make investing social and accessible to everybody. What drew me to this app was the group side; it was the primary investing app that allowed its customers to share their trades and portfolios with each other. It appeared to be so much like twitter however with investing being the one topic. Public permits its customers to observe different buyers and see their portfolios, their trades, their communications, and anything they need to share. This was extraordinarily useful to me as a newish investor after I joined. Public gives a variety of shares, ETFs, and cryptocurrencies, so customers have loads of choices to select from. The app additionally has a zero-commission coverage, which signifies that customers can spend money on shares and ETFs with out paying any charges.

Public’s different notable options

Apart from Public’s social side, they supply a bunch of different helpful options that actually units it aside from the remainder. They not too long ago launched a brand new Classes function, incentivizing customers to undergo a easy training immediate and quiz. Then after they full the quiz, they get a number of {dollars} price of inventory for a related firm in that discipline. It finally ends up being a win-win. Since Public focuses on sharing amongst customers, they adopted the Areas function from Twitter. They maintain open “city corridor” sort classes the place they invite CEOs of corporations to speak concerning the market and what their firm does. It’s nice to sit down and hearken to what they’ve say and listen to how they place themselves available in the market.

Public additionally has nice comparability instruments so you may stack up totally different shares in opposition to one another and make an informed determination on what to buy subsequent. Most not too long ago, additionally they opened a excessive yield treasuries account the place customers can earn 5.3% APY on their cash, which is the best I’ve seen thus far. Public does supply a paid tier of the app that provides extra options like portfolio administration instruments and after-hour buying and selling, however for me, the free tier is greater than sufficient.

Total, I believe Public is a superb investing app for anybody, whether or not you might be simply getting began or you might have been at it for some time. It’s an effective way to be taught, construct group, and work together with different individuals in an area that you simply in any other case wouldn’t have. This has been my favourite app to make use of personally within the final two years.

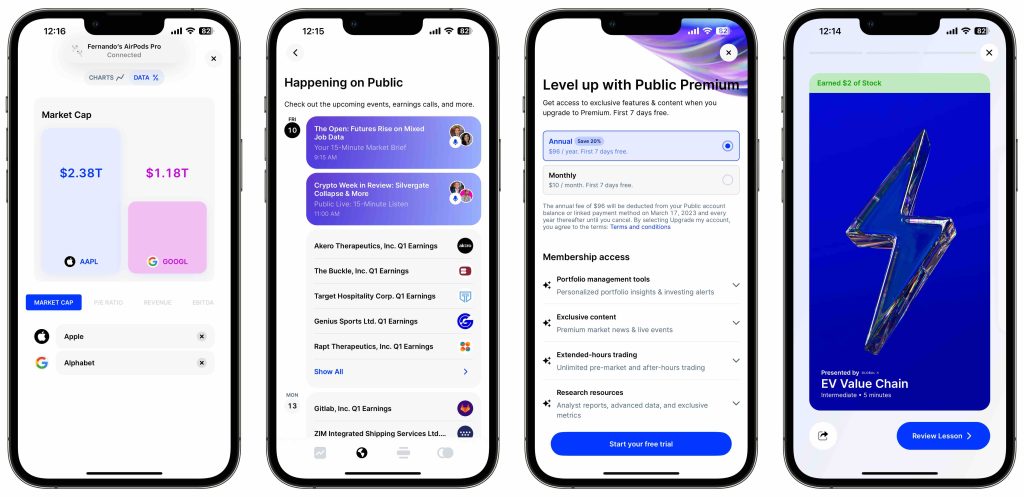

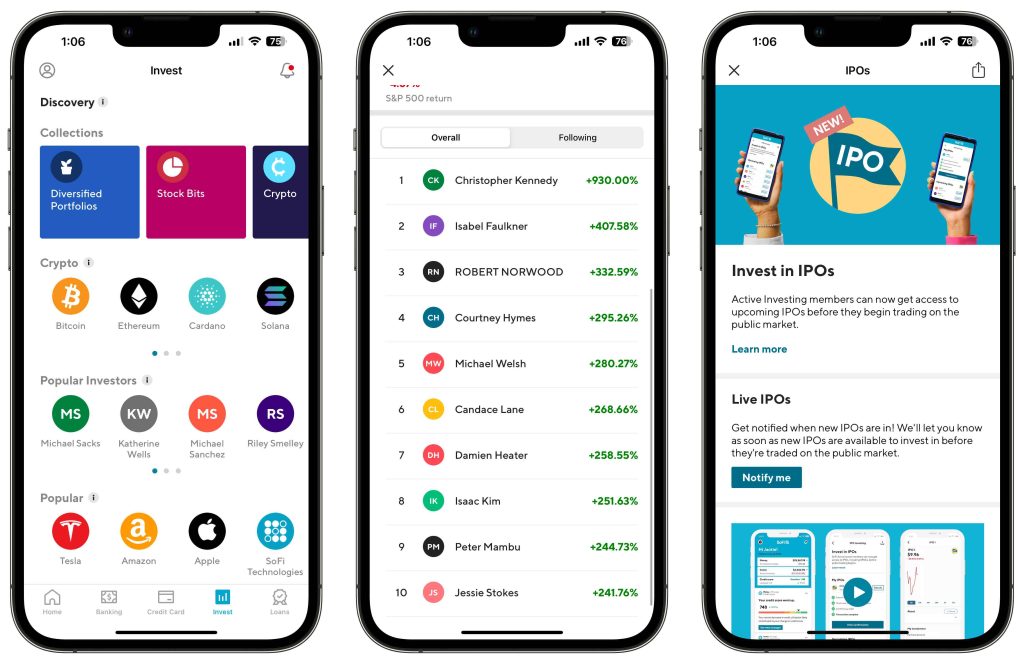

SoFi Investing is an investing app that’s a part of the bigger SoFi ecosystem, which incorporates private loans, scholar mortgage refinancing, and extra. For those who learn my article on my high three fashionable banking apps, you’ll know that I take advantage of Sofi as my essential financial institution of selection. I like having the ability to have my checking, financial savings, retirement, and investing accounts all underneath one roof. SoFi Investing gives a variety of funding choices, together with shares, ETFs, and cryptocurrencies. SoFi additionally gives the power to plan for retirement with Roth IRA accounts that may be simply managed from the app.

What attracts me to SoFi investing is its education-first method; SoFi supplies the whole lot you have to know to get a base stage of understanding of the inventory market. Customers are taught to make educated choices based mostly on what they discovered about each the inventory and the inventory market itself. In addition they present perception into different merchants’ accounts to point out what their break up is. They exhibit their earnings and inventory watch listing. It’s an effective way to get began.

There are a number of notable options to take a look at when contemplating utilizing SoFi. They provide all the identical no-fee buying and selling capabilities that different opponents have, however another options are:

- Free after-hours buying and selling

- Capability to spend money on IPO corporations

- Breaking apart shares into Collections

- Providing well-known ETF funding choices

- Gamification with leaderboards

The large standout options are the power to have after hours buying and selling in addition to the power to spend money on IPOs. When you have a SoFi investing account then you should have the power to spend money on corporations earlier than they even hit the inventory market. So if you’re assured in an upcoming firm that’s about to go public, then you may spend money on them earlier than anybody else!

One final function to say is the leaderboards. SoFi has gamified the investing expertise a bit by creating leaderboards of what % progress different buyers have seen. So if you’re a aggressive particular person and need to see how your portfolio stacks in opposition to the remainder, this function is for you!

If you’re already within the SoFi ecosystem, then investing with them is a no brainer. I take advantage of it as my retirement investing account in addition to an IPO investing account; the principle attraction of SoFi is the UI of the app. You may inform that they need individuals to take a position from their telephones and never from a desktop or pc, so investing with SoFi is an especially nice expertise.

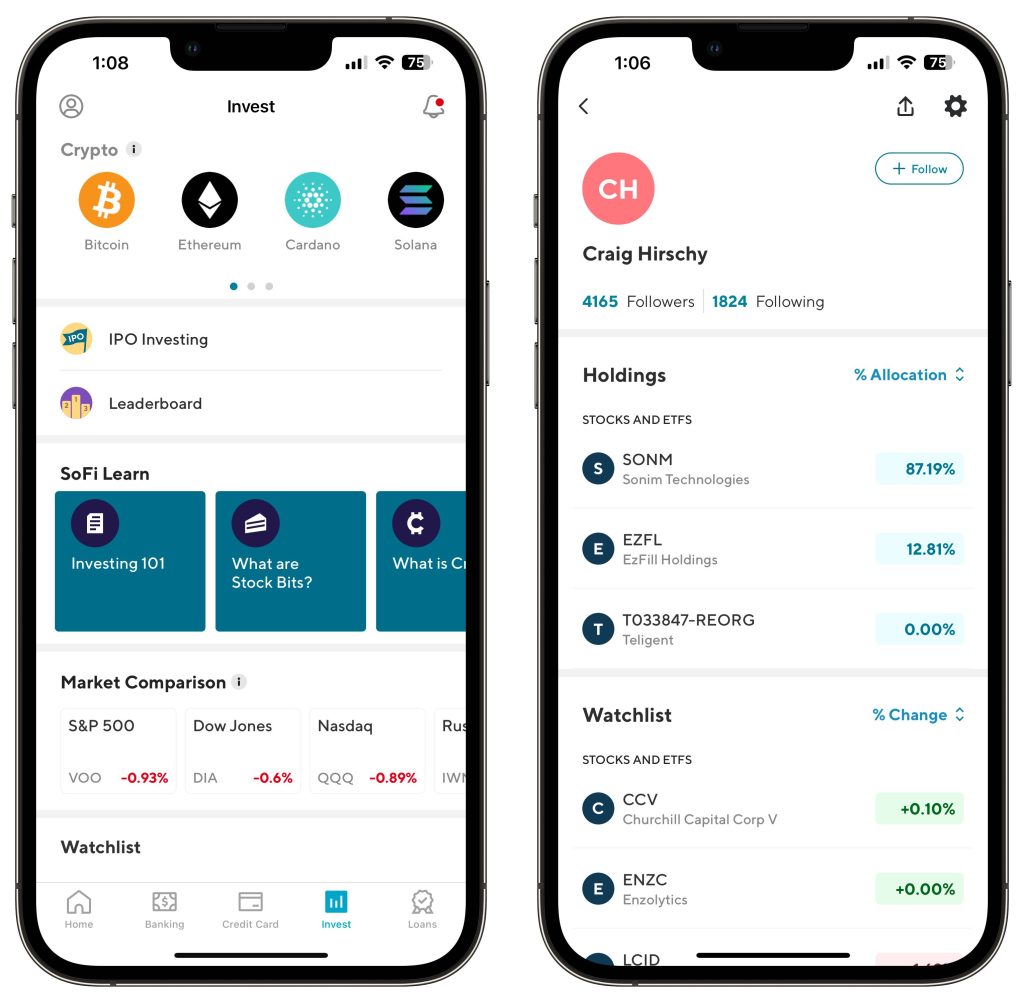

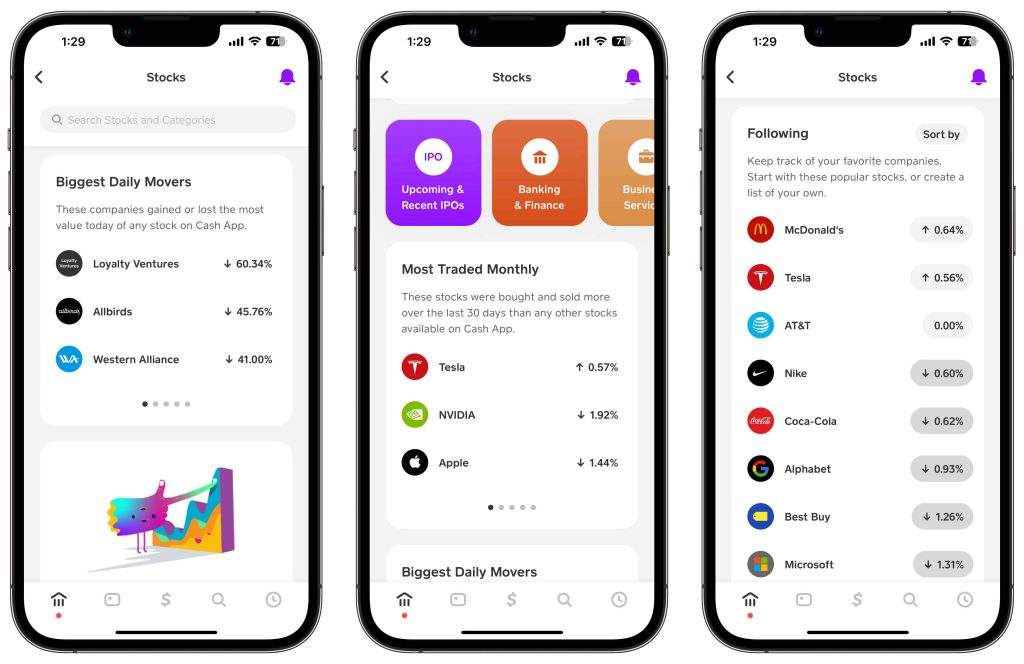

Sure, you learn that accurately, Money App has made the listing of high investing apps for iOS. Now hear me out! Money App is called a cash switch app. Folks use it like they use Zelle or Venmo to pay associates or companies. Just a few years again, they determined to supply their very own investing companies, and I find it irresistible. Money App investing is the primary app I used to get into the retail investing area. If anybody is moving into the investing area for the primary time, particularly youthful customers, then begin with Money App.

Simplicity is the final word function

One of many standout options of Money App Make investments is its simplicity. The app is designed to be user-friendly, with a easy interface that makes it straightforward for anybody to start out investing. Moreover, Money App Make investments gives a variety of academic content material, together with articles and movies on numerous investing matters. The app is very simple. You get your portfolio quantity entrance and middle, then they provide you related information tales, they present the shares you observe after which provide you with some stats on the remainder of the market.

It’s easy to arrange an account, and if in case you have a Money app account already, it’s even simpler. All you must do is join a debit card, and start your investing journey. The most effective function of Money App Make investments is its integration with the Money App ecosystem. Customers can simply switch funds between their Money App account and Money App Make investments, making it straightforward to handle their investments and different monetary transactions in a single place. Money App supplies all of the instruments needed to start out investing – you get information, and training, and also you get a pleasant breakdown of particular person inventory statistics, permitting you to make an informed determination shifting ahead.

Once more, I do know that Money App will not be actually seen as an investing app, however that is the investing app that I’d suggest to any and all novices. You’ll be shocked by how a lot Money App gives from an investing standpoint. The familiarity and ease of the app are what units it aside.

Wrap-up

We stay in a world right this moment, that inside 5 minutes you may obtain an app, get verified, hyperlink your checking account, and begin investing. So, for me, what units an app aside from the remainder is how handy and environment friendly can we make the method of investing. I’m not a day dealer, so I don’t need to be in entrance of my pc 24/7 buying and selling all day. I would like to have the ability to arrange computerized investments, scroll for 10 minutes in my investing app to get some information, and get on with my day. Lengthy-term investing is my objective, and these apps have helped me get there.

Use what works finest for you. In case your financial institution gives investing platforms, look there first. If you wish to diversify a bit, then be at liberty to examine a few of these out. Let me know what you consider these selections! Have you ever heard of those platforms? Have you ever used them earlier than? What do you at the moment use to take a position your cash? Let’s talk about within the feedback!

FTC: We use revenue incomes auto affiliate hyperlinks. Extra.