Final yr Apple hinted that iOS 16 would carry not less than two new companies associated to Apple Pay, asserting Apple Pay Later alongside the iOS 16 unveiling at June’s Worldwide Builders Convention (WWDC), adopted by plans for a brand new Apple Card Financial savings Account shortly after iOS 16 was launched to the general public.

Though the corporate didn’t provide a lot perception into when both of those companies would launch, hints within the iOS 16.4 betas made it obvious that Apple was laying the groundwork for each. Apple Pay Later soft-launched on the finish of March, inviting “inviting choose customers to entry a prerelease model” of the service, with a full rollout anticipated “within the coming months.”

Now, Apple has delivered on its second monetary service of iOS 16, asserting that its new high-yield financial savings account is reside for all Apple Card customers to get pleasure from.

How It Works and Who Is Eligible

Apple’s new financial savings account is completely out there for people who’ve an Apple Card, which implies it’s additionally solely out there the place the Apple Card is out there — in the USA.

If you have already got an Apple Card, there aren’t any further necessities to arrange an Apple Financial savings account aside from having iOS 16.4 (or later) put in on the iPhone the place your Apple Card is about up.

Basically, the brand new financial savings account is meant to permit Apple Card customers to squirrel away their Each day Money rewards and earn curiosity slightly than retaining them of their non-interest-bearing Apple Money account.

To that finish, Apple Card customers can select to have all their Each day Money rewards mechanically deposited into their new financial savings account — whether or not that’s the 1% money again from purchases made with the bodily titanium card or the three% from Apple Retailer purchases.

Financial savings helps our customers get much more worth out of their favourite Apple Card profit — Each day Money — whereas offering them with a straightforward approach to save cash day by day. Our purpose is to construct instruments that assist customers lead more healthy monetary lives, and constructing Financial savings into Apple Card in Pockets allows them to spend, ship, and save Each day Money instantly and seamlessly — all from one place.

Jennifer Bailey, Apple’s vice chairman of Apple Pay and Apple Pockets

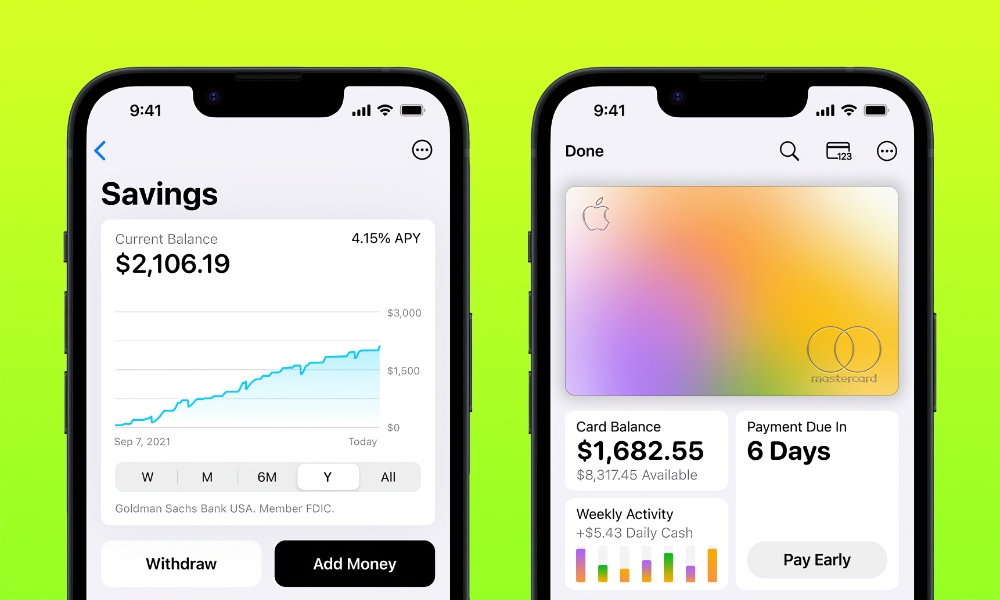

The financial savings account at present carries a 4.15 % Annual Proportion Yield (APY), and there’s no minimal steadiness required to earn that APY, so Apple Card customers can get began straight away.

Nonetheless, Each day Money isn’t the one approach so as to add cash to an Apple financial savings account; like Apple Money, you may hyperlink an exterior checking account to withdraw or deposit funds by way of ACH Switch. Whereas there’s no potential to spend cash instantly from the brand new financial savings account, funds can simply be transferred into Apple Money and spent from there by way of Apple Pay. There aren’t any switch charges both approach.

As with the Apple Card, Goldman Sachs is offering the brand new financial savings account, which is ruled by phrases and situations just like most on-line financial savings accounts.

Naturally, the Apple financial savings account is about up, tracked, and managed by means of Apple Pockets in your iPhone, which is why you want iOS 16.4. The method is just like managing your Apple Money or Apple Card, with added data to indicate your curiosity earned over time.

If you happen to’re an Apple Card proprietor or co-owner, you may join the brand new Apple Financial savings account by opening the Pockets app in your iPhone, tapping in your Apple Card, choosing Each day Money from the three-dot menu, after which selecting the “Apple Card Financial savings Account” possibility on your Each day Money vacation spot.