Apple on Tuesday introduced that it’s inviting “choose customers” to make use of the prerelease model of Apple Pay Later. Invites will seem within the Pockets app, in addition to in an e mail despatched to the e-mail deal with used as their Apple ID.

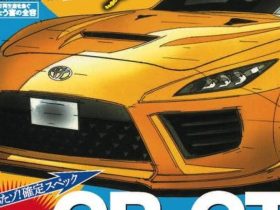

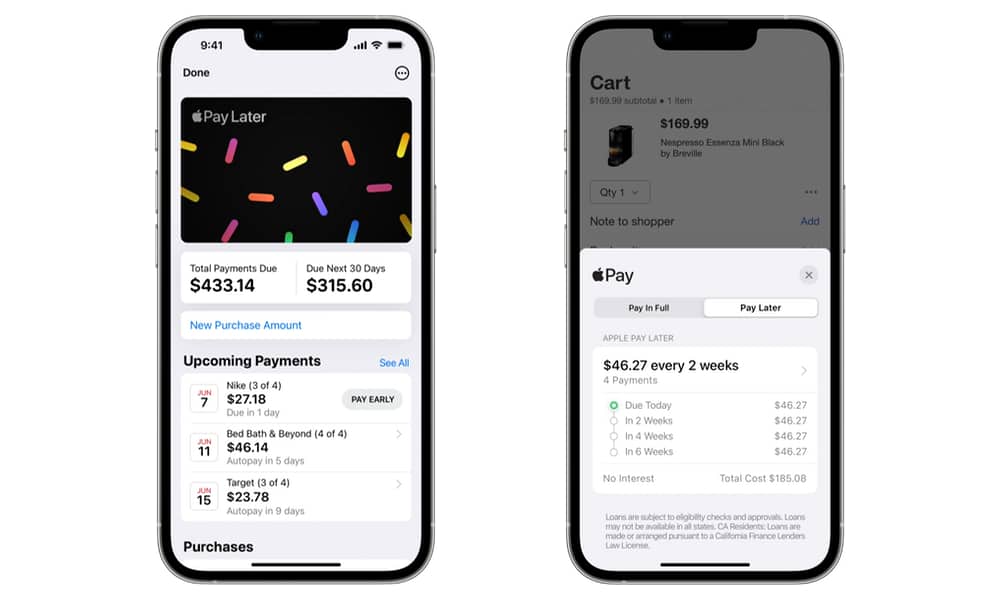

Apple first introduced the Apple Pay Later “purchase now, pay later” financing possibility at WWDC 2022. This system permits certified U.S. clients to separate their Apple Pay purchases into 4 equal funds which are unfold over six weeks, with out paying any charges or curiosity.

Customers will apply for Apple Pay Later loans starting from $50 to $1,000. They will then use the short-term mortgage to make on-line and/or in-app purchases by way of Apple Pay on their iPhone or iPad.

At present, Apple is limiting entry to Apple Pay Later to customers in the US and requires iOS 16.4 and iPadOS 16.4 to be put in on the machine. Apple says the Apple Pay Later plan might be supplied to all eligible iPhone customers 18 years of age and older within the “coming months.”

Purposes might be made for an Apple Pay Later mortgage by way of the Pockets app with no affect to their credit standing. Candidates want merely enter the quantity they’d prefer to borrow, conform to the phrases of this system, and wait as a comfortable credit score verify is carried out. As soon as the mortgage is permitted, Apple Pay Later will turn out to be a fee possibility in Apple Pay.

Apple Pay Later might be accessible within the iPhone Pockets app, the place customers can view, monitor, and handle their loans in a single location. Customers can view their upcoming funds, and notifications of upcoming funds might be obtained each within the Pockets app and by way of e mail. Funds might be made by debit card. Bank cards can’t be used to make funds on the account.

“There’s no one-size-fits-all method relating to how folks handle their funds. Many individuals are on the lookout for versatile fee choices, which is why we’re excited to supply our customers with Apple Pay Later,” stated Jennifer Bailey, Apple’s vp of Apple Pay and Apple Pockets. “Apple Pay Later was designed with our customers’ monetary well being in thoughts, so it has no charges and no curiosity, and can be utilized and managed inside Pockets, making it simpler for shoppers to make knowledgeable and accountable borrowing choices.”

There’s no one-size-fits-all method relating to how folks handle their funds. Many individuals are on the lookout for versatile fee choices, which is why we’re excited to supply our customers with Apple Pay Later.”Jennifer Bailey, VP

All credit score evaluation and lending is dealt with by Apple Financing LLC, an Apple subsidiary. If a service provider accepts Apple Pay, clients will see Apple Pay Later as an possibility at checkout on-line and in apps.

Restrictions and Necessities for the Apple Pay Later Program

- Customers have to be 18 years of age or older.

- Customers should both be a U.S. citizen or a lawful resident.

- Customers should have a legitimate, bodily U.S. deal with. P.O. Packing containers can’t be used.

- Apple Pay have to be arrange in your machine with an eligible debit card. Apple Pay Later down funds can’t be made utilizing a bank card.

- Two-factor authentication have to be arrange in your Apple ID.

- The consumer’s machine have to be up to date to the newest model of iOS or iPadOS.

- The consumer’s id might have to be verified with a Driver’s License or a state-issued photograph ID.

Till right this moment, Apple Pay Later entry was a part of an early testing program that was restricted to Apple retail and company workers.

Extra details about Apple Pay Later might be discovered on this Apple help doc.

This data first appeared on Mactrast.com