Apple introduced final week that it could start inviting “choose customers” to the prerelease model of its Apple Pay Later program. The invites would come within the iPhone Pockets app, in addition to in an electronic mail despatched to a person’s electronic mail connected to their Apple ID. A brand new report immediately by 9to5Mac says it seems that the invites are rolling out a bit slowly, as immediately is the primary day anybody has publicized being invited to hitch the Apple Pay Later early entry program.

Developer Dylan McDonald this morning shared on Twitter that he had acquired an invitation.

Bought entry to Apple Pay Later! pic.twitter.com/UTI4BFu8If

— ????? (@DylanMcD8) April 5, 2023

If and while you obtain an invite to take part in this system, you’ll obtain an electronic mail from Apple providing early entry to this system, in addition to info explaining how the characteristic works.

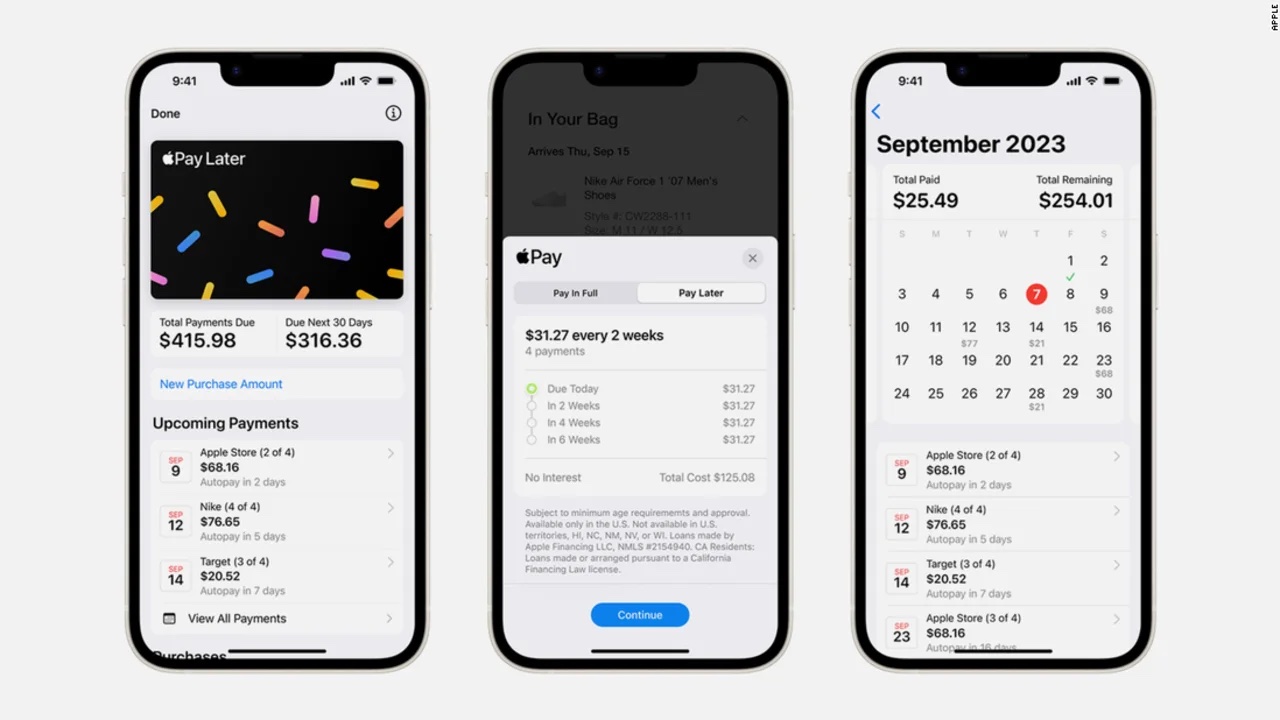

Get early entry to a prerelease model of Apple Pay Later, and begin spreading purchases over 4 smaller funds, with no curiosity or charges. Accessible on-line and in apps the place Apple Pay is accepted with iPhone or iPad.

Making use of for Apple Pay Later is straightforward. Make sure you’ve up to date to the most recent iOS or iPadOS — then head to Pockets, faucet +, and select Apple Pay Later. Request an quantity to spend and, if authorized, you’ll see the Pay Later choice behind the Apple Pay button at checkout.

When you’ve acquired the “early entry” electronic mail, it’s best to merely load the Pockets app in your iPhone to provoke the appliance course of.

Customers could make an software for an Apple Pay Later mortgage within the Pockets app with no affect on their credit standing. Candidates will enter the quantity they’d prefer to borrow ($50 to $1,000), comply with this system’s phrases, and watch for Apple to carry out a gentle credit score verify. As soon as the applicant’s mortgage is authorized, “Apple Pay Later” will present up as a fee choice in Apple Pay.

Customers will even be capable to view, monitor, and handle their loans within the Pockets app. Customers will be capable to view upcoming funds, in addition to notifications of upcoming funds in each the Pockets app and by way of electronic mail. customers could make funds with a debit card. Bank cards are usually not allowed for use to make funds on the credit score account.

Apple unveiled Apple Pay Later practically one 12 months in the past at WWDC 2022. This system is a “purchase now, pay later” financing choice permitting qualifying prospects within the U.S. to separate an Apple Pay buy into 4 equal funds unfold over six weeks. There aren’t any curiosity or charges.

All credit score evaluation and lending shall be dealt with by Apple subsidiary, Apple Financing LLC. If a service provider accepts Apple Pay, prospects will see an “Apple Pay Later” choice at checkout, each on-line and in apps.

For extra details about Apple Pay Later, learn this Apple assist doc.

This info first appeared on Mactrast.com