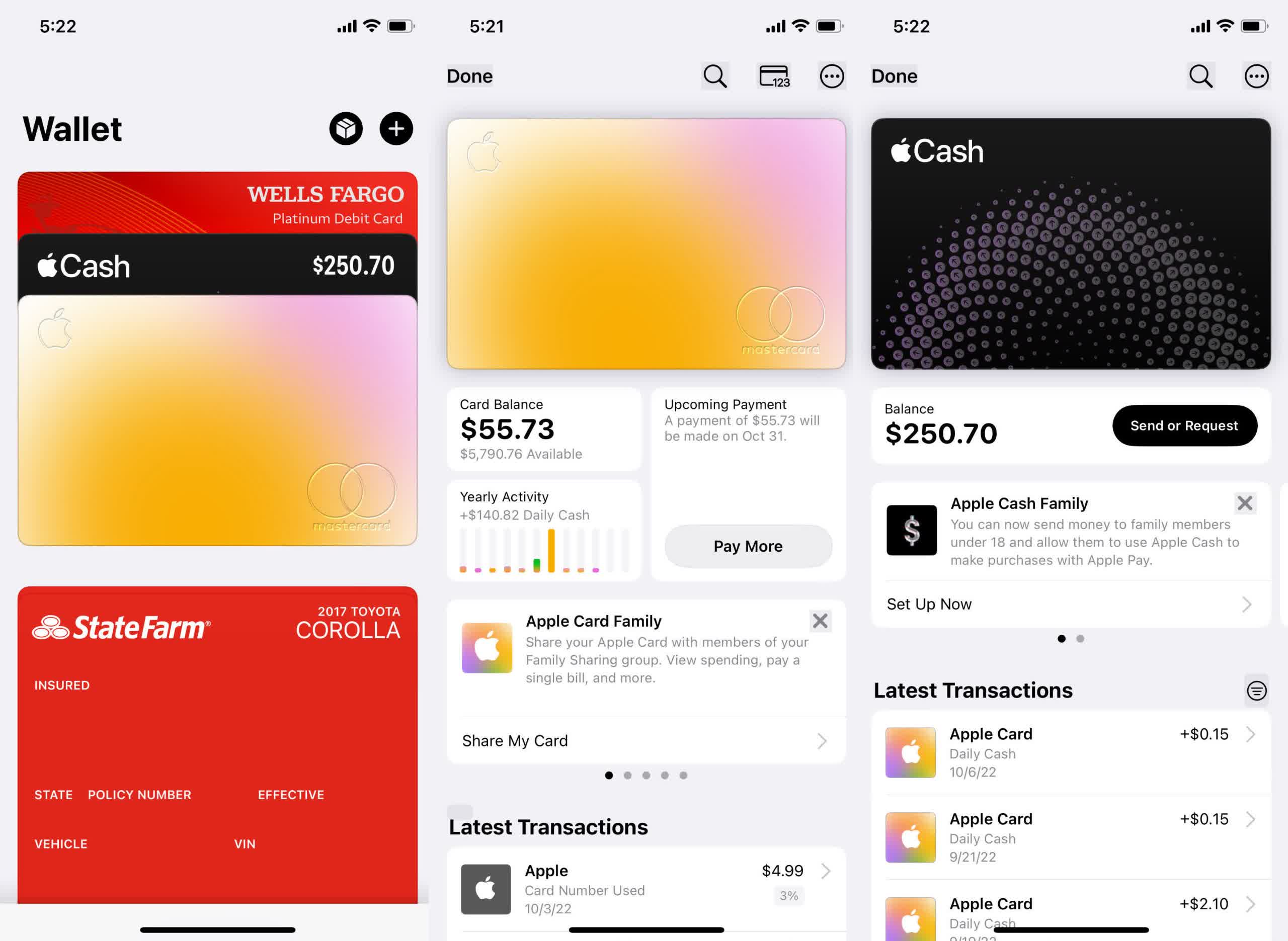

The massive image: In case you were not paying consideration, Apple is now a financial institution. I jest, however solely just a little. It began with the Apple Card, and now the tech large desires to carry your cash, too. In fact, it’s utterly elective, but it surely does have some benefits if you’re already an Apple cardholder.

As of Might 2021, there have been 6.4 million Apple Card customers. Backed by Goldman Sachs, the general service is in style for its handy options, together with Apple Pay and pockets app integration, real-time balances, on-device account administration, money again, and safe card/CVV numbers.

Apple Card has been profitable sufficient that Cupertino now desires to carry your financial savings. On Thursday, the corporate introduced it could quickly provide “high-yield” financial savings to Apple Cardholders.

“Apple introduced a brand new Financial savings account for Apple Card that may enable customers to save lots of their Every day Money and develop their rewards in a high-yield Financial savings account from Goldman Sachs,” Cupertino mentioned.

This is the way it works. Apple Card is already set as much as give customers three p.c again on Apple purchases (in-store or digital) and two p.c for transactions with taking part distributors like Walgreens, ExxonMobil, T-Cell, and others. All different prices get a one-percent return.

At the moment, this cash is saved on a separate digital card in iPhone homeowners’ wallets referred to as “Apple Money.” It acts like a pre-paid debit card drawing in opposition to the Apple Money steadiness. Prospects can even switch funds to their common checking account. In different phrases, the cash sits there till they do one thing with it.

Apple is proposing to place that cash right into a high-yield Goldman Sachs financial savings in order that it may possibly earn much more. As soon as customers arrange an account, Every day Money will routinely begin depositing into the financial savings as an alternative of Apple Money. Nonetheless, clients can nonetheless choose to have the cash go into the digital card in the event that they like.

“Customers can change their Every day Money vacation spot at any time,” the press launch mentioned.

Apple did not outline “excessive yield,” however something is healthier than nothing, which is what most banks give patrons on financial savings accounts. The characteristic may be one other engaging perk for Apple Card clients if it is actually high-yield, particularly contemplating the few banks that also provide interest-baring accounts normally present considerably lower than one p.c.

Like all playing cards saved within the Pockets app, the financial savings account could have a administration display screen with comparable choices like viewing rewards and different actions. Customers can even switch funds to and from their hooked up checking accounts (used for making Apple Card funds), making it like a daily money deposit account, simply with out the brick-and-mortar financial institution.

Rising the expansion potential of Every day Money is a pleasant little incentive to put aside just a little “free cash,” particularly for people who not often contact it anyway. It might come in useful for sudden expenditures or occasional splurging. If it actually is high-yield, it’d even be a greater choice than customers’ present financial savings accounts. Regardless, it is arduous to think about present cardholders saying “no thanks” to more money, whatever the yield.