A sizzling potato: In one other instance of society’s growing abandonment of money, some branches of a large financial institution have stopped coping with bodily cash over-the-counter. It comes after years of falling ATM use, a pattern that drastically accelerated throughout Covid.

The Australia and New Zealand Banking Group (ANZ), Australia’s second-largest financial institution by belongings, not too long ago stated {that a} important drop in in-branch transactions has led it to cease dealing with money at some branches.

ANZ advised NCA NewsWire that money and cheque deposits and money withdrawals would solely be attainable at these branches through the use of the onsite SmartATMs. Financial institution workers will likely be available to assist clients who could haven’t beforehand used the machines – as a substitute of dealing with money behind the counter, presumably.

The explanation behind the choice is that Australia, like the remainder of the world, is utilizing much less money. As per The Reg, Australia’s Reserve Financial institution stories that the usage of money in day-to-day transactions has been declining for the reason that mid-2000s.

The quantity and worth of ATM withdrawals in Australia have declined by 60% and 40%, respectively, since 2008. Money withdrawals took an enormous nosedive throughout the pandemic, and have solely barely recovered since then.

Australians made 75 million ATM withdrawals within the month of December 2008. That felt to simply 31 million in February 2021, a slight enchancment over the 21 million withdrawals made throughout the Covid lockdowns.

With extra individuals favoring digital funds over conventional bodily strategies, ANZ stated fewer individuals are visiting banks, with a 50% decline in in-branch transactions during the last 4 years. “Solely eight p.c of our clients solely depend on branches for his or her on a regular basis banking wants, with the bulk preferring on-line and cell banking strategies,” stated an ANZ spokesperson, including that the majority clients who go to are there to debate massive and complicated monetary transactions.

We at the moment are on the ‘give me comfort or give me demise’ stage of Western civilisation.

ANZ Financial institution ends money withdrawals from its branches – as the tip of paper notes looms. It is faucet and go from right here on in…https://t.co/Y99GQF8Vrd pic.twitter.com/p9vSCZhRVA

— dystopian down beneath (@dystopian_DU) March 30, 2023

Regardless of the world transferring nearer to a cashless society, some Australians have expressed outrage on the financial institution’s determination. “I am going to let my 90-year-old Italian grandmother know that she will be able to (no) longer entry her personal cash in a supposedly first world nation,” one social media person wrote. “It is disgusting, what in regards to the aged who do not have debit playing cards and solely have financial institution books?” stated one other.

However with simply 13% of purchases in Australia now utilizing banknotes or cash, loads of individuals stated they will perceive why the financial institution is making this transfer.

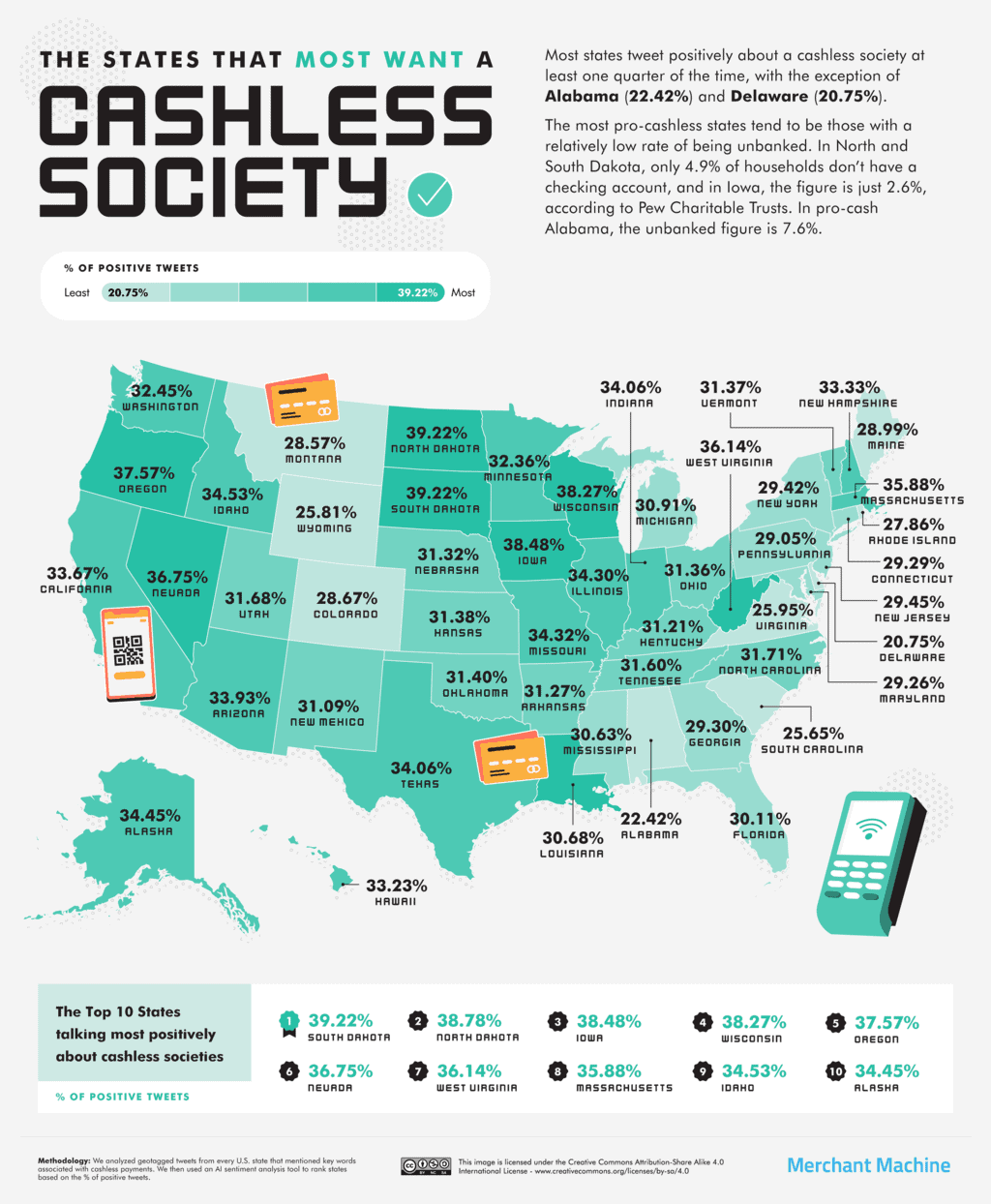

Again in November, a report advised that solely two states within the US have been against a cashless society: Alabama and Delaware. Regardless of objections, it more and more appears as if we’re quickly heading on this path, whether or not individuals prefer it or not.