The large image: This 12 months’s declining demand for tech merchandise continues to have an effect on reminiscence and different pc elements. The most recent quarter noticed costs fall but once more alongside an unprecedented income drop. Analysts aren’t positive when situations will change, however producers are slicing manufacturing and delaying transition plans in response.

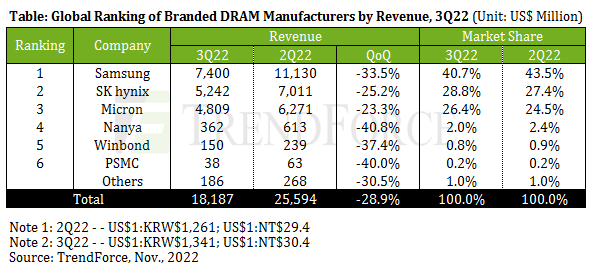

In keeping with TrendForce analysts, world DRAM income fell by 28.9 % within the third quarter of this 12 months in comparison with the earlier quarter. The decline is the most important for the reason that 2008 monetary disaster.

Moreover, Q3 DRAM contract costs dropped by between 10 and 15 % in comparison with Q2. That fall roughly aligns with the predictions from TrendForce’s Q2 report from July, when costs fell 10.6 % year-over-year. Server DRAM shipments additionally declined in Q3.

Among the many three largest DRAM distributors, Samsung noticed the most important income drop – down 33.5 %. Nevertheless, the corporate’s general market share grew from 40 to 43 %. SK Hynix and Micron every noticed income lower by round 1 / 4. Micron’s decline was the smallest among the many massive three as a result of it stories its numbers otherwise.

Out of the highest six DRAM firms, Nanya took the most important income hit at 40.8 % on account of its higher reliance on DRAM and mainland China clients. PSMC suffered virtually as severely, seeing 40 % much less income in Q3 from its in-house branded DRAM merchandise. Lastly, Winbond’s falling shipments induced a 37.4 % income contraction.

The state of affairs has induced suppliers to decelerate their plans for growth and transition to new applied sciences. Falling demand for digicam modules induced Samsung to restrain its transfer from DRAM to CMOS picture sensors. Micron delayed mass manufacturing of its 1-beta node course of. Winbond lowered manufacturing at its Taichung fab this quarter and delayed mass manufacturing at its new Kaohsiung fab.

The market downturn has induced RAM and SSD costs to slip all through 2022. Nevertheless, manufacturing cuts imply these costs might backside out late this 12 months, so customers trying to capitalize on low cost reminiscence and storage may wish to accomplish that quickly.

Along with SSDs and RAM, falling demand has additionally impacted TVs, smartphones, Chromebooks, graphics playing cards, and different gadgets. Firms together with Nvidia, Intel, Meta, and Amazon have felt the ache, although Apple’s most up-to-date quarter held agency on account of sturdy Mac gross sales.

In earlier stories, analysts could not say how lengthy it might take into subsequent 12 months for tech markets to start out recovering. Now, TrendForce thinks DRAM distributors can have challenges adjusting stock via the primary half of 2023.