During the last 12 months, I’ve jumped deep into the world of bank card rewards, maximizing redemption values, assortment factors and money again, and benefiting from profitable welcome bonuses. One of many apps that I’ve used to study extra about all of that is CardPointers, a superb app from the indie developer Emmanuel Crouvisier.

I bought an opportunity to speak to Crouvisier about CardPointers, iOS 16, what it’s’ like being a full-time indie developer in 2022, and far more. Plus, an unique low cost and supply for 9to5Mac readers.

Fingers-on: CardPointers might help maximize bank card rewards

The competitors within the bank card business has actually heated up over the past a number of years. Firms together with American Categorical, Chase, and Capital One have ramped up their provides with huge welcome bonuses, new redemption provides, profitable spending and rewards classes, and far more.

Talking from expertise, this may be overwhelming and complicated at first. It’s simple to make errors; particularly when card firms entice you to redeem for low redemption values. CardPointers goals that will help you navigate all of those conditions.

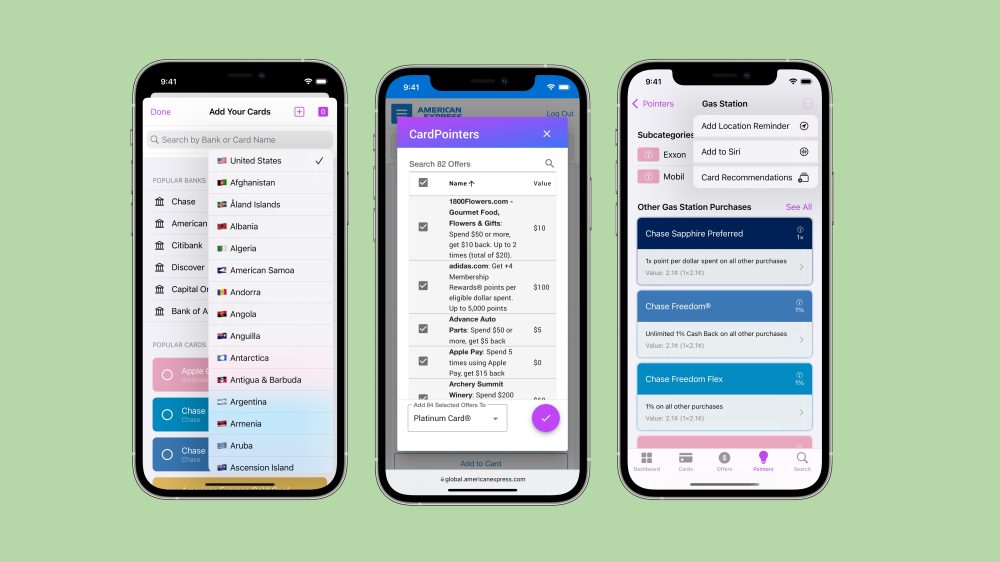

Whenever you open CardPointers for the primary time, you’ll be prompted to undergo the method of including the bank cards you have already got. Throughout this course of, you’ll be able to add the date that you just had been permitted, regulate the bonus classes if wanted, and think about the entire out there provides.

Inserting the date you had been permitted for a card is especially vital if the cardboard has a welcome bonus or an annual charge. CardPointers might help you monitor your progress in the direction of a welcome bonus and remind you when your annual charge is about to be charged.

The latter is particularly vital if you wish to attain out to your card firm and see if there are any retention provides out there to assist offset the annual charge. (Trace: There often are, you simply must threaten to cancel/downgrade your card first.)

When you’ve added your current playing cards to CardPointers, you’ll be able to faucet on the “Pointers” tab to see a breakdown of one of the best playing cards to make use of for various classes of spending. These ideas are based mostly purely on the playing cards you have already got. For example, when you have the Amex Gold Card, you’ll probably see that it’s the most suitable choice for many restaurant and grocery retailer purchases.

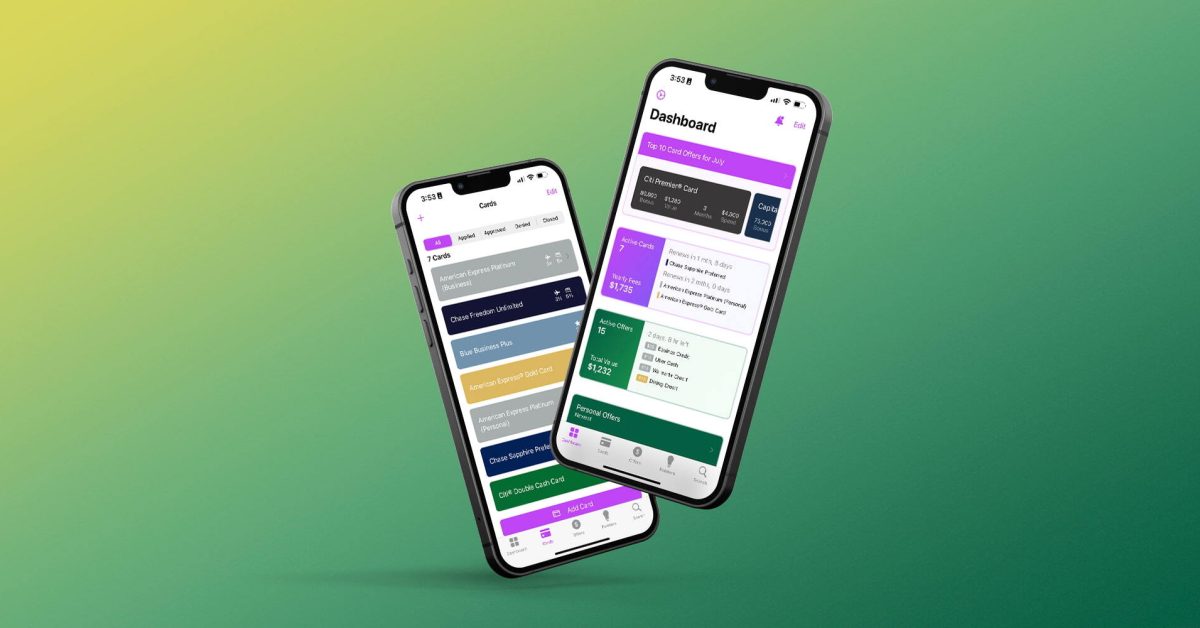

The “Dashboard” tab within the CardPointers app breaks down further details about the playing cards you have got. This features a listing of your playing cards, the full of your annual charges, your lively provides, and extra particulars on one of the best playing cards for various classes of spending.

Lastly, the “Dashboard” additionally features a roundup of one of the best card provides for the month when it comes to welcome bonuses. In the event you’re trying to develop your arsenal of bank cards, this can be a very helpful device for seeing welcome bonuses for among the prime playing cards on the market.

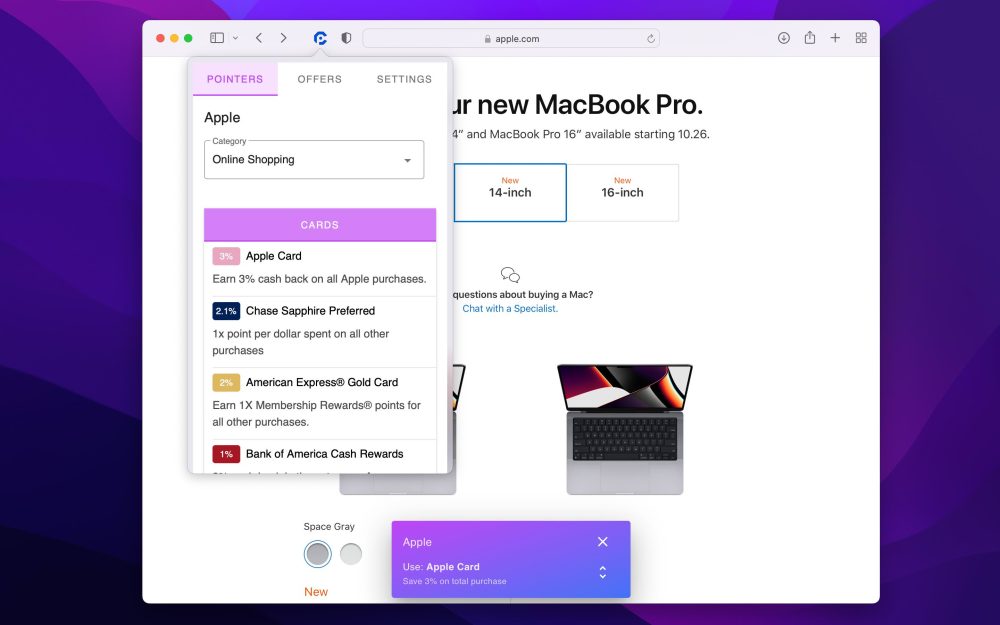

Safari Extension

One among my favourite elements of CardPointers is the Safari Extension. The Safari Extension is offered on iPhone, iPad, and Mac. It’s major goal to let you know one of the best bank card to make use of on a selected web site to maximise the money again or factors you’ll obtain for a purchase order. For instance, should you’re reserving a lodge, the CardPointers extension will present you which ones of your playing cards provides one of the best rewards for that buy.

One other glorious perk of the CardPointers extension for Safari is that it helps the power to activate your whole out there provides on the Chase and American Categorical web sites.

Whenever you go to Chase or American Categorical, you’ll see a CardPointers notification that shortly permits you to enroll in your provides. When you do, the provides may even sync to your CardPointers account and be factored into the entire ideas and pointers.

CardPointers helps quite a lot of completely different system options of iOS, macOS, and iPadOS. This contains issues like App Clips, Sign up with Apple, Residence Display screen widgets, Fast Notice, Siri integrations, and extra. There’s additionally a devoted Apple Watch app in addition to apps for iPad and Mac.

You may get began with CardPointers via this hyperlink and get an unique 20% off for being a 9to5Mac reader.

iOS 16

I had the chance to talk with the developer of CardPointers, Emmanuel Crouvisier, this week. One factor I used to be particularly fascinated by was what he has deliberate for iOS 16 and Apple’s different new software program releases coming this fall. His reply? Mainly the whole lot.

Crouvisier: The primary day of WWDC I all the time assume I’ll have only some little issues to include into my app to assist preserve it feeling recent, however by the point I’m performed watching the entire pertinent session movies, I’ve bought a to-do listing of 100+ objects. This 12 months isn’t any completely different.

- App Intents: These make creating new shortcuts *so* quick and simple for builders. I already had 5 shortcuts within the app, however with the power to have one routinely enabled upon app set up, it makes them a lot extra approachable for customers who wouldn’t usually enterprise into the Shortcuts app. I’ve made some huge updates to my “Which Card?” shortcut, and now a person can simply say the title of a retailer, relatively than simply the kind of buy they’re making, and the app will immediately inform them which card to make use of there to maximise their factors or use an Amex or Chase supply that they’ve there. It even works completely with Siri, so if a person simply has their AirPods in, they can use Hey Siri and know which card to make use of in a second with out having to tug out their telephone or verify the watch app.

- Focus Filters: Apple lastly bought me to make use of Focus modes because of them, and I can’t think about working every other method now. I’ve adopted Apple’s lead right here on implementation, and I’ve been utilizing these throughout my Work focus to point out solely my enterprise playing cards all through the app, and I created a customized focus mode referred to as Journey which I’ve set to filter out the entire playing cards with overseas alternate charges within the app so I don’t get stunned by a 3% added cost on my purchases when overseas. It’s a characteristic a number of customers have requested for, and integrating this through focus filters was an ideal match.

- Lock Display screen Widgets: I’ve had problems within the Watch app since v1, and widgets since they had been out there, and now I’ve bought a brand new place to let customers put the data that issues most to them. This shall be an awesome spot so as to add a reminder a couple of particular class bonus and expiring provides, and I’ll be exploring a couple of new concepts as nicely.

- Swift Charts: That is probably the most superb API I’ve seen come out of Apple. In just some traces of code you may get actually lovely charts with nice accessibility options, but it could possibly do some actually advanced issues with a couple of extra traces; it’s an enormous addition to SwiftUI. There are numerous purposes for charts all through the app which I’ve been desirous to do for some time, however didn’t wish to construct my very own chart library. Drawback solved!

Going indie

At the start of this 12 months, Crouvisier made the choice to stop his full-time job at a startup and focus completely on CardPointers. With the broader context of latest App Retailer modifications, I requested him how his first six months of being full-time indie have gone.

Crouvisier: I feel that’s one of the best choice I’ve ever made for myself! I’ve been engaged on CardPointers since 2019, and almost your complete time I’ve additionally been working at a startup, which meant ~16 hour work days, sacrificing sleep to have time to work, no evenings or weekends to loosen up, and I undoubtedly hit some unhealthy burnout intervals, particularly late summer time getting ready for iOS launch days every year.

Since I stop the startup job and have been in a position to focus solely on CardPointers, actually the whole lot in my life has improved: I’m sleeping nicely every single day, I get to decompress (some) evenings and weekends (I’m nonetheless a little bit of a workaholic), and CardPointers is doing higher than ever — my first 2 months solely centered on the enterprise I tripled income in 2 months by specializing in advertising the app and extension and rising the enterprise, relatively than simply bettering the app.

Apple’s Small Enterprise Program has been nice to save lots of 15% on App Retailer gross sales, however I’ve discovered a number of profit in leveraging internet checkout through Stripe and RevenueCat to save lots of much more, and likewise keep underneath the Small Enterprise most income restrict for longer. From a person perspective, nothing beats the convenience of an in-app buy, apart from a reduced worth through Apple Pay via an online checkout move. The 2 collectively work fantastically nicely to cowl all forms of customers.

Apple Card

Lastly, given his in-depth and unequalled data of the bank card business and rewards, I requested Emmanuel for his ideas on Apple Card. His recommendation? You’re most likely higher off with a distinct card.

Crouvisier: There are such a lot of extra benefits to a very good rewards card, like a Chase Freedom, Sapphire Most well-liked, Citi Premier, or Amex Gold card. With these playing cards you’ll be able to earn transferable factors which you’ll switch to airways and resorts to get much more worth out of the factors that you just earn — and their factors multipliers for many classes are a lot larger than the Apple Card, too.

With the Apple Card probably the most you may get is 3% again in your buy, whereas with the playing cards I’ve talked about, you may get 5x again in factors on some classes like eating places, gasoline stations, and so forth, and people factors are price much more as you’ll be able to redeem them for issues like enterprise class seats to Europe.

If somebody spends $10,000 on their Apple Card in a 12 months they’ll get again at most $300, whereas the identical $10k spend on a very good rewards card can earn them 50,000 factors, and people factors could be price 4c or extra with a very good redemption, that means the actual worth could be $2,000. Actually 7x extra worth out of utilizing a very good rewards card, and that’s what CardPointers helps customers do — earn extra from each buy simply by paying with the proper card.

Even should you simply wish to concentrate on money again, different playing cards can earn the identical money again because the Apple Card on much more classes and retailers. I’d like to see the Apple Card additional enhance their earnings classes, and increasingly more banks are doing offers immediately with particular retailers as a type of promoting, so I feel we’ll proceed to see extra of that throughout all playing cards as a brand new income for them.

Wrap up

CardPointers is offered as a free obtain, with an in-app subscription out there to unlock the CardPointers Professional options.

9to5Mac readers can save 20% on CardPointers Professional’s annual and lifelong plans. Actually, should you improve to the Lifetime plan with this hyperlink, you’ll additionally get a $100 Financial savings Card that successfully makes the improve free.

Extra developer interviews:

FTC: We use earnings incomes auto affiliate hyperlinks. Extra.

Take a look at 9to5Mac on YouTube for extra Apple information: