It’s been solely two weeks since Apple formally opened the floodgates on its new high-yield financial savings account, and sources say it’s already attracted practically $1 billion in deposits from Apple customers wanting to money in on its profitable 4.15% Annual Proportion Yield (APY).

The numbers, which haven’t been publicly disclosed, come from two “sources aware of the matter” who shared them with Forbes. In line with these sources, the brand new account, which requires an iPhone and an Apple Card, drew practically $400 million in deposits on the primary day alone. Within the three days following the launch, an extra $590 million in deposits have proven up, bringing the full to $990 million earlier than the week ended.

Whereas that feels like some huge cash — and it’s by itself — it’s additionally unfold throughout a lot of clients. One supply informed Forbes that roughly 240,000 accounts had been opened within the first week, which might put the typical deposit quantity at lower than $4,200.

Nonetheless, it’s a reasonably vital uptake for an account that requires holders to not solely have an iPhone but additionally already be the proprietor or co-owner of an Apple Card. What’s much less clear, although, is how a lot of that cash was transferred in from different financial institution accounts and the way a lot was merely a results of individuals shifting their Every day Money balances into the brand new Apple Financial savings account.

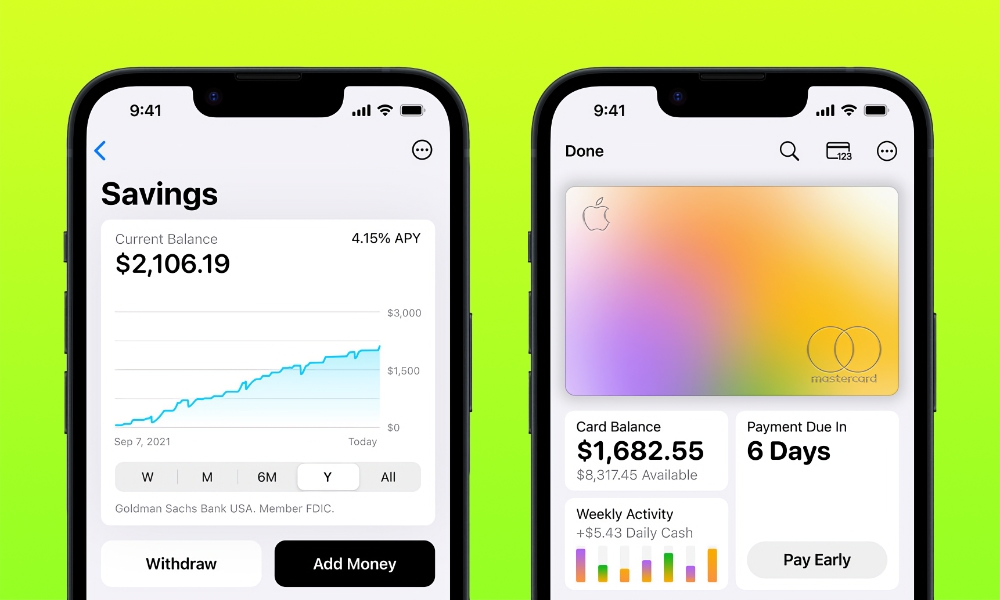

When organising a brand new Apple Financial savings account — one thing that may be performed in beneath 5 minutes straight out of your iPhone’s Pockets app — any Every day Money that’s accrued from Apple Card purchases could be robotically transferred into the Apple Financial savings account, the place it goes from incomes zero p.c curiosity to a 4.15% APY.

All future Every day Money rewards additionally get funneled into the Apple Financial savings account, from the 1% money again from purchases made with the bodily card to the three% from Apple Retailer purchases, plus different Every day Money promotions.

Beneath these phrases, it could be virtually insane for an Apple Card proprietor not to arrange an Apple Financial savings account, which in all probability accounts for such a speedy uptake. On prime of that, as Forbes’ Emily Mason factors out, the 4.15% makes it a gorgeous vacation spot for different financial savings even past Every day Money — and it’s sarcastically greater than Apple’s banking companion’s personal high-yield financial savings account.

The account’s eye-catching 4.15% annual return, plus the ubiquity of iPhones, is probably going the principle driver for account openings, particularly when the typical financial institution is paying lower than half a p.c.

Emily Mason, Forbes

Lengthy earlier than it partnered with Apple to again the Apple Card, Goldman Sachs had created a client model of its personal often called Marcus. Mason notes that this model additionally provides a high-yield financial savings account — however at a comparatively meager 3.9%.

For sure, at 4.15% APY, Apple’s Financial savings account is a giant deal. Whereas there are competing companies like Robinhood that do barely higher, these are a part of extra complete — and sophisticated — packages for savvy traders. In contrast, the Apple Financial savings account is a no-frills high-yield account that follows the corporate’s “simply works” philosophy and could be arrange in minutes by anyone with an iPhone and an Apple Card.

It additionally seems like this preliminary billion {dollars} is simply the tip of the iceberg. In line with Crone Consulting, a funds agency cited by Forbes, an estimated $3.8 billion in Every day Money rewards have flowed into the Apple Money accounts yearly. For the reason that overwhelming majority of Apple Card customers are doubtless to enroll in an Apple Financial savings account and choose to have their Every day Money land there, it’s truthful to say that almost all of that $3.8 billion will find yourself in Apple Financial savings accounts, which is able to doubtless be added to as clients select to maneuver their financial savings over from lower-yield accounts and investments to make the most of Apple’s 4.5% APY.