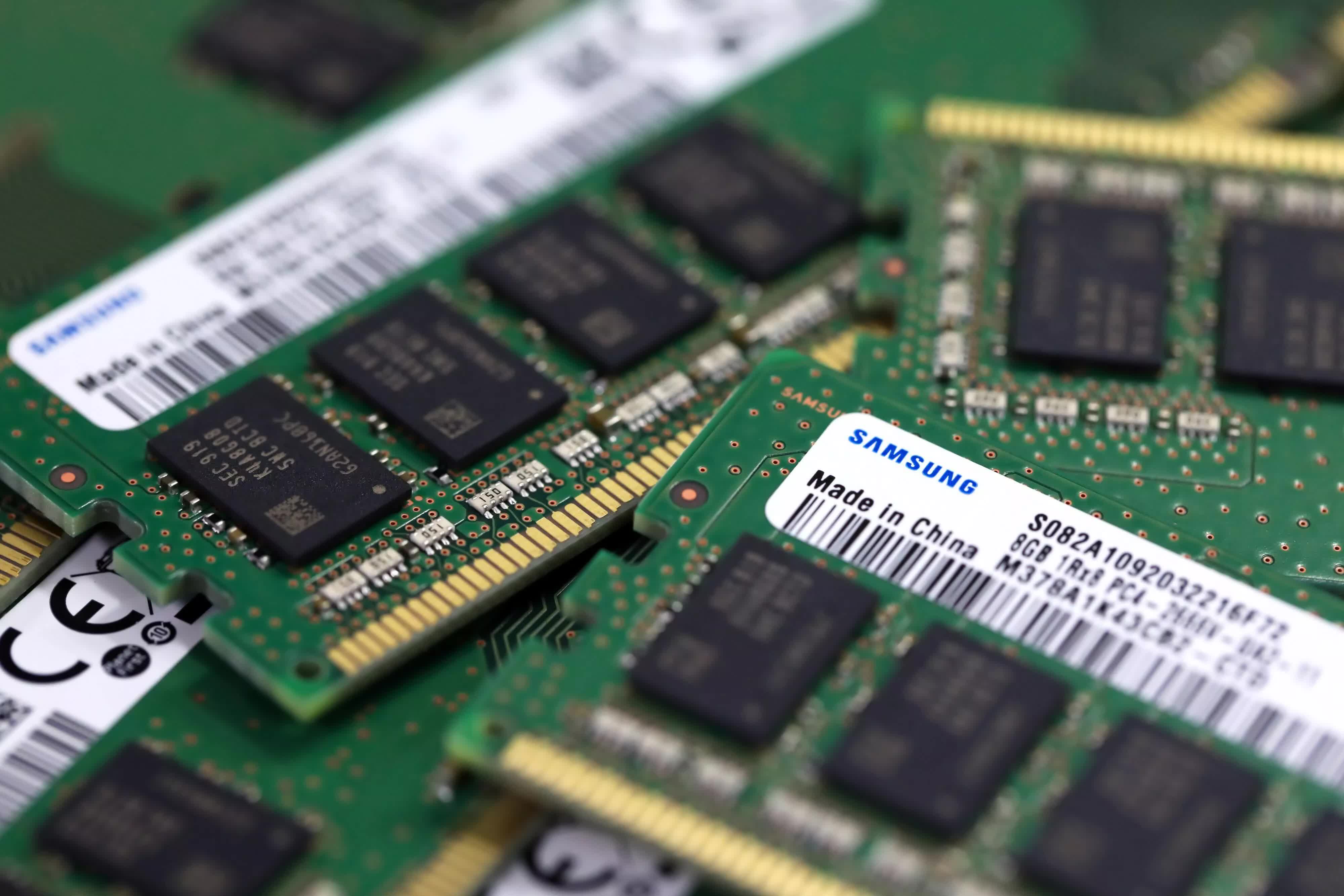

The massive image: Worldwide IT spending and client demand for electronics have each taken a big hit in current months, prompting many firms to revise their income forecast. Samsung isn’t any exception however the firm has been reluctant to scale back manufacturing in a bid to protect its dominant place within the reminiscence market. As reminiscence costs attain new lows and earnings fade away, nonetheless, the world’s largest producer of DRAM and NAND chips sees no different possibility however to make fewer of them for some time.

Final 12 months, Samsung noticed the primary style of the financial downturn with a DRAM and NAND provide glut in South Korea. As demand for its chips continued to slip, the corporate scrambled to beat TSMC within the race to develop probably the most superior course of node, hoping to woo purchasers of the Taiwanese rival.

Quick ahead to final month, and the issue had solely grown after a vacation quarter turned out to be one of many worst since 2008. In reality, the entire DRAM market plunged to 2008 lows, prompting firms like Micron and SK Hynix to scale back their revenue margins, minimize down on new investments, and lay off workers.

Samsung has even taken a 20 trillion received mortgage from its show subsidiary to attempt to cowl the chipmaking division’s expenditures with ongoing manufacturing facility developments in South Korea and the US. The thought was possible born of optimism for a rebound in client demand for PCs and smartphones later this 12 months, however trade watchers do not see that occuring till subsequent 12 months on the earliest. Even enterprise IT spending is slowing as firms massive and small are searching for extra methods to chop prices.

Because of this, the Korean tech large will cut back chip manufacturing to what it calls a “significant degree” in an effort to maintain reminiscence costs from falling additional.

The corporate’s newest earnings steering suggests it solely made round 63 trillion received (~$48 billion) in gross sales in the course of the three months ending in March, representing a 19 % lower over the earlier quarter. Extra importantly, working revenue is projected to have fallen greater than 95 % to only 600 billion received (~$456 million).

A Samsung spokesperson advised Korea Herald the transfer to scale back chip output is merely a short-term resolution meant to stabilize costs and discourage extreme stockpiling. The corporate remains to be hopeful reminiscence orders will develop over time, so it’ll proceed to take a position closely in modernizing manufacturing traces and creating extra superior reminiscence chips. It even enlisted AMD’s assist to make sooner and extra energy-efficient DDR5 based mostly on a 12nm course of.

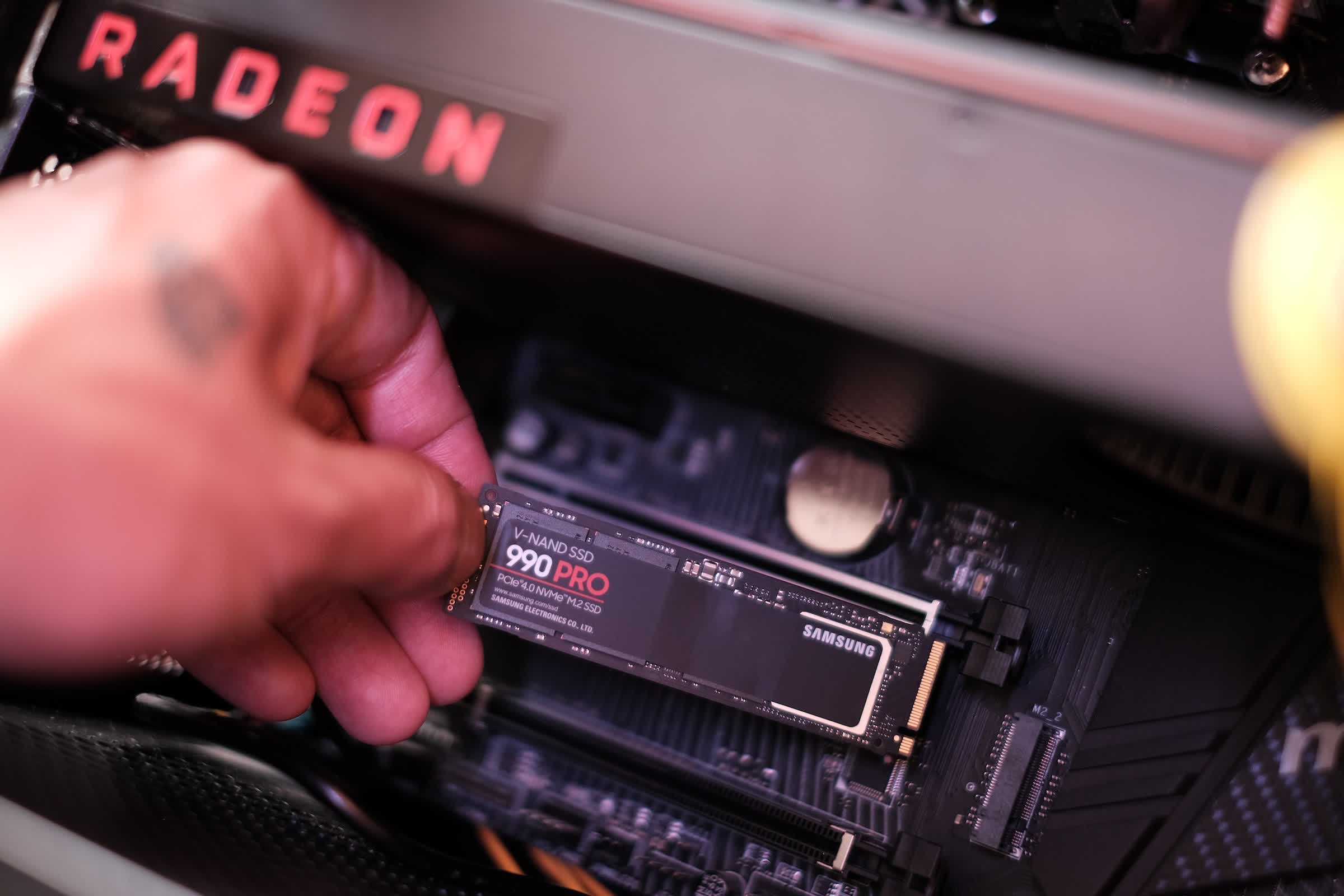

For customers, this implies DRAM and SSD costs have but to succeed in a ground. Analysts at TrendForce consider DRAM particularly might rise up to fifteen % cheaper this summer time, that means DDR5 kits will turn into extra accessible to these trying to make important upgrades to their PCs.

The typical promoting value of M.2 SSDs has additionally fallen steadily over the previous a number of months, a development that appears set to proceed into the second half of this 12 months. Simply be careful for pretend Samsung SSDs, as these have additionally turn into a typical prevalence when looking for offers on-line.

Masthead credit score: Babak Habibi